Grow Wealth With Adelaide Investment Loan

Build your portfolio, create passive income, and secure your family’s financial future, with support from a local Adelaide team who knows the SA property market.

FACE BEHIND BOUJEE

Committed To Offering Top-Notch Support

Prabhat Badal is an experienced mortgage broker based in Adelaide, South Australia, with a background specializing in hospitality and education & migration sectors. After spending years working in these industries, he is now dedicated to helping his clients find the right mortgage solutions from first home buyers to help people pay off their loans faster. Prabhat is well-regarded for his exceptional knowledge of the industry, strong work ethic, and commitment to providing excellent service.

Prabhat specializes in helping various types of clients in their first home or investment loan journey. He understands that the right loan isn’t solely determined by the lowest interest rate but also involves considering all loan features to reduce mortgage amounts and durations.

A local team that knows your suburbs.

Clear advice on the deposit you actually need.

Access to 40+ lenders, including local credit unions.

Expert help with SA’s First Home Grant & stamp duty.

WHY US

Why Choose Boujee For First Time?

We know the Adelaide market, the lenders, and the government incentives that make your first home more achievable.

Smart Tax Strategies

Expert advice on negative gearing, tax benefits, and cash flow.

Competitive Rates

Access to lenders offering competitive investment loan rates.

Wealth Building Loans

Loan structures designed to support long-term wealth growth.

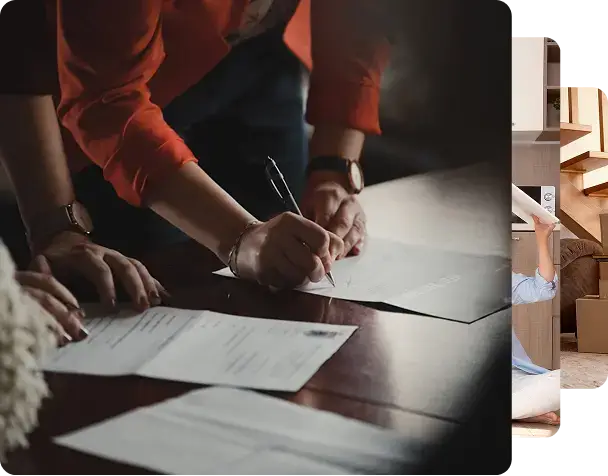

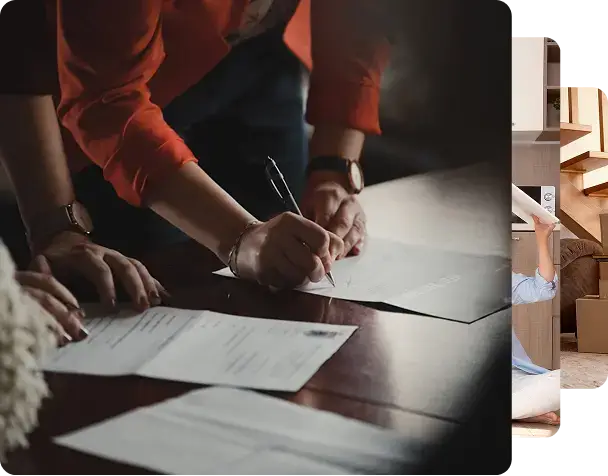

INVESTOR HOME LOAN

What is an Investor Home Loan?

An investment home loan is designed for borrowers who want to purchase property as an investment rather than as their primary residence.

With Boujee, you’ll benefit from:

WHY CHOOSE US

WHY Boujee Home Loans

Deep understanding of SA’s property market and rental yields.

Access to 40+ lenders including local credit unions and major banks.

Guidance for first-time investors and experienced landlords alike.

Ongoing support to manage loan structures as your portfolio grows.

BORROWING POWER CALCULATOR

How Much Can You Borrow In Adelaide?

OUR PROCESS

Made Simple For First- Timers

STEP 1

Consultation

Share your investment goals (first property, portfolio growth, equity release).

STEP 2

Loan Strategy

We compare interest-only, fixed, and variable investment loans.

STEP 3

Approval & Purchase

We Secure your loan and start building wealth.

TESTIMONIAL

Stories From People Like You

FAQ’s

Refinancing FAQs in Adelaide & South Australia

What’s the difference between an owner-occupied loan and an investor loan?

Many lenders accept as little as 5%, and with government schemes you may need even less. Boujee will help you explore the right options.

Can I use equity from my Adelaide home to invest?

Typically, you’ll need 5–20% deposit. But some Adelaide lenders offer low-deposit loans or options with LMI (Lenders Mortgage Insurance).

Do lenders in South Australia offer special investment loan options?

It’s rare, but certain guarantor loans or government schemes can make this possible. We’ll explain if you qualify.

Is negative gearing still beneficial in Adelaide?

We help clients across Adelaide: Glenelg, South Plympton, Marion, Prospect, Mawson Lakes, and beyond.

How much deposit do I need for an investment property in SA?

We help clients across Adelaide: Glenelg, South Plympton, Marion, Prospect, Mawson Lakes, and beyond.

COMPLIANCE AND LEGAL

Important Terms and Conditions For Your Support

Loan Approval

Loan offers subject to eligibility and lender approval.

Comparison Rates

Comparison rates calculated on standard assumptions.

Financial Advice

This content is general in nature and not financial advice.

Turn Your Borrowing Power Into Real Home Loan

Use the calculator, check your eligibility, and let Boujee Home Loans handle the rest.